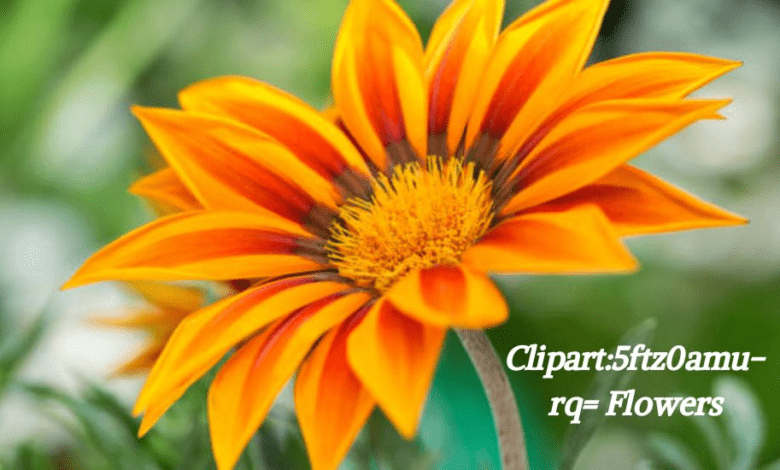

Clipart:5ftz0amu-rq= Flower

Flower Clipart: A Versatile Visual Element for Your Designs

Clipart:5ftz0amu-rq= flower has become a staple in digital design, adding a touch of beauty, elegance, and nature-inspired charm to various projects. Whether you’re working on invitations, presentations, posters, or social media graphics, flower clipart can be a quick and effective way to enhance your designs. In this post, we’ll explore the benefits of using flower clipart, different styles available, and how to use it creatively in your work.

Why Use Clipart:5ftz0amu-rq= flower?

- Aesthetic Appeal: Flowers have long been symbols of beauty and emotion, making flower clipart an easy way to add a visually pleasing element to any design. From roses to daisies, the variety of floral options allows for flexibility in matching different themes.

- Versatility: Flower clipart is versatile enough to be used in a wide range of designs, from formal wedding invitations to casual blog posts. With transparent backgrounds or vector formats, they can seamlessly integrate into any composition.

- Time-Saving: For those not skilled in drawing or digital illustration, clipart provides an accessible way to include artistic elements in your work without spending hours creating them from scratch.

Read Also: Drawing:qzi52oodt7s= girls

Popular Styles of Flower Clipart

There are many styles of flower clipart to choose from, each catering to different design needs:

- Minimalist Flowers: These simple, clean lines make for modern and understated designs. Perfect for sleek, professional projects or minimalist layouts.

- Watercolor Flower Clipart: This style adds a hand-painted, delicate feel to your designs, ideal for feminine and soft themes such as wedding invitations or spring-related graphics.

- Vintage Floral Clipart: Featuring detailed, retro-style flowers, vintage clipart offers a nostalgic and timeless appeal, great for heritage-inspired designs or antique aesthetics.

- Bold and Bright Flowers: For more playful and vibrant projects, clipart with bold, bright flowers can add energy and fun, making it suitable for children’s designs, party invitations, or promotional materials.

Creative Ways to Use Flower Clipart

- Invitations: Adding floral clipart to invitations for weddings, birthdays, or baby showers can enhance the elegance and theme of your event. You can position flowers around text, use them as borders, or even as subtle watermarks behind the content.

- Social Media Posts: Flower clipart works wonders in adding flair to Instagram stories, Pinterest pins, or Facebook posts. You can overlay flowers on quotes, highlight key points, or simply use them as decoration.

- Presentation Slides: Incorporating flower clipart into business presentations or personal slides can break the monotony of text-heavy slides, making the presentation more engaging and visually appealing.

Read Also: Map:dmpu8ctr0bw= Switzerland

Conclusion

Incorporating Clipart:5ftz0amu-rq= flower into your designs can save time while elevating the aesthetic quality of your project. With so many styles and types available, finding the right floral elements to match your vision is easy. Whether you need minimalist elegance, watercolor charm, or bold vibrancy, flower clipart is a simple but effective tool to enhance your creative work.

Feel free to explore online repositories of flower clipart to find the perfect match for your next project!